A study reveals that China’s dominance in cobalt production, particularly in the Democratic Republic of the Congo, poses a threat to U.S. supply chain strategies as it intersects with regulatory concerns from the Inflation Reduction Act. Chinese firms control two-thirds of cobalt in the DRC, with significant implications for future mining supply categorizations under U.S. legislation.

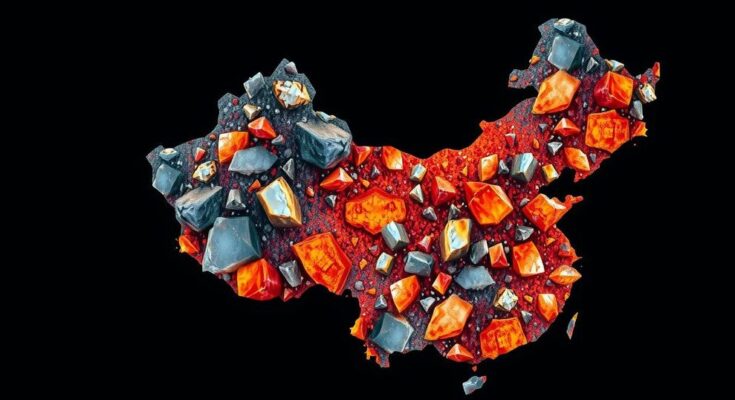

The increasing dominance of China in the critical minerals sector, particularly with regard to cobalt, is posing significant challenges to Washington’s supply chain strategies. A recent study by Benchmark Minerals highlights that Chinese companies exert control over approximately two-thirds of cobalt production in the Democratic Republic of the Congo (DRC), which itself generates an estimated 74 percent of the global supply. This concentration of control raises concerns regarding potential conflicts with the Foreign Entity of Concern clause embedded within the U.S. Inflation Reduction Act (IRA). This clause particularly targets entities that are owned or controlled by geopolitical adversaries, such as China, Russia, Iran, and North Korea. CMOC, formerly known as China Molybdenum Company, is noted as a leading cobalt supplier, operating its primary mining facilities within the DRC, specifically at the Tenke Fungurume mine and the Kisanfu project. According to Benchmark Minerals, projections indicate that by 2024, 60 percent of the worldwide mined cobalt supply may originate from assets that are classified under the Foreign Entity of Concern designation or are at risk of being categorized as such. The implications of these findings underscore the precarious nature of U.S. efforts to diversify supply chains and secure critical minerals necessary for technological and renewable energy advancements.

Cobalt is a vital component in various technologies, including batteries for electric vehicles and renewable energy storage. Due to the global transition towards cleaner energy sources, countries, particularly the United States, are increasingly dependent on a stable supply of critical minerals. However, supply chains are heavily influenced by geopolitical factors. The U.S. Inflation Reduction Act introduces measures to mitigate reliance on foreign entities deemed problematic, primarily those from nations considered adversarial. Given that China controls a substantial portion of essential mineral resources, particularly cobalt, the U.S. faces a complex challenge in ensuring a resilient supply chain while navigating legislative restrictions.

In summary, China’s substantial control over cobalt resources places U.S. supply chain ambitions at considerable risk. With companies like CMOC leading production in the DRC and the potential for a large portion of the cobalt supply to fall under scrutiny from the U.S. legislation—specifically the Foreign Entity of Concern clause—Washington must navigate these challenges carefully. The findings from Benchmark Minerals accentuate the urgent need for the United States to diversify its sources and minimize reliance on entities classified as threats.

Original Source: www.scmp.com